how do you calculate cash flow to creditors

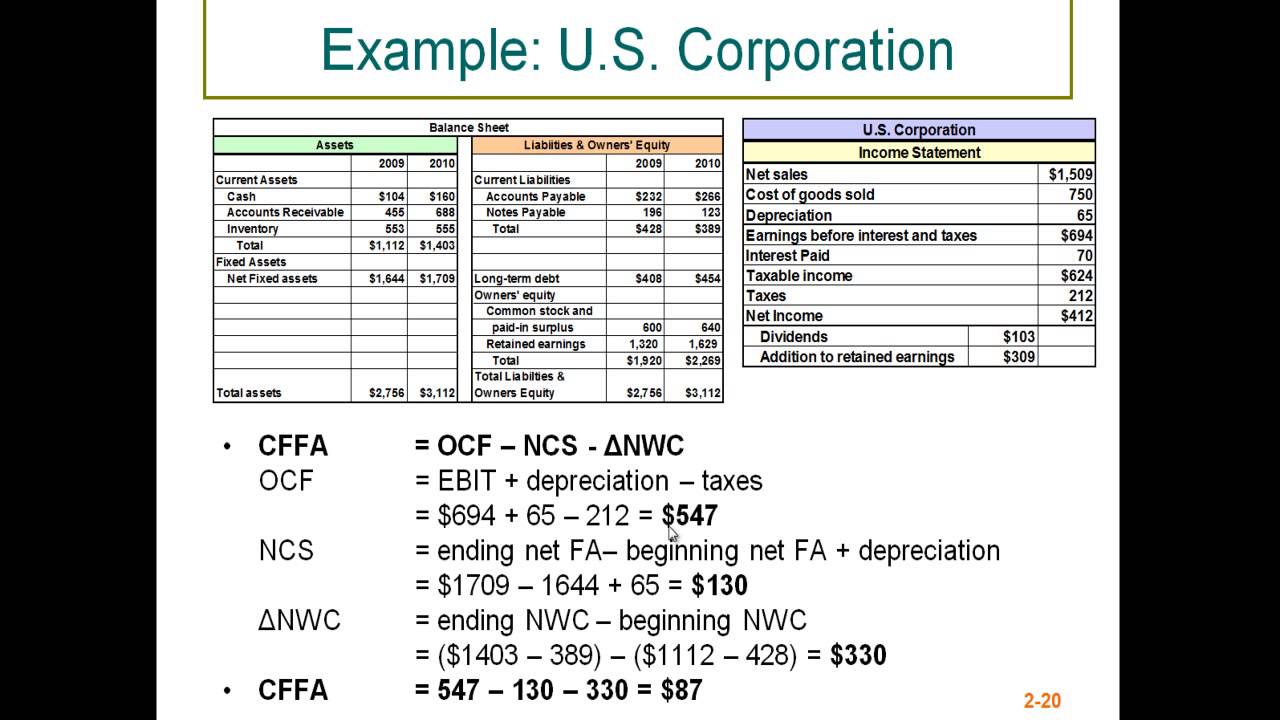

Cash flow from Assets - Cash flow to creditors Cash flow to stockholders. We Manage Receivables Payables To Streamline Processes Grow Your Business.

Blank Income Statement Template Fresh Blank In E Statement And Balance Sheet Aoteamedia Statement Template Income Statement Mission Statement Template

Get 3 cash flow strategies to stop leaking overpaying and wasting your money.

. Ad Customized Cash Flow Management Solutions From MT Bank. Operating Cash Flow Net Income -. In this case depreciation and amortization is.

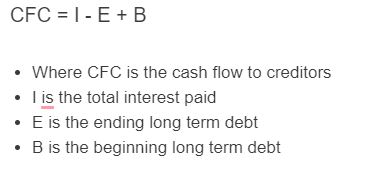

Ad Download our toolkit to learn how to forecast cash flow statements even in uncertain times. Cash Flow to Creditors is also known as Cash Flow to Bondholders. With these components in mind the discounted cash flow formula is as follows.

The formula of cash flow to creditors interest paid net new borrowing. DCF Sum of cash flow in period 1 Discount rate Period number. The formula of cash flow to.

Since so many transactions involve non-cash items you have to alter how you calculate their effect on cash flow. By Student May-2022 Uncategorized. Start calculating operating cash flow by taking net income from the income statement.

How do you calculate cash flow to creditors if you are not given long term debt. Operating Cash Flow Formula. Cash Flow Forecast Beginning Cash Projected Inflows Projected Outflows Ending Cash.

The Statement of Cash Flows also referred to as the cash flow statement is one of the three key financial statements that report the cash generated and spent during a specific. Ad QuickBooks Financial Software. Cash flow to creditors Interest paid Lon View the full answer Transcribed image text.

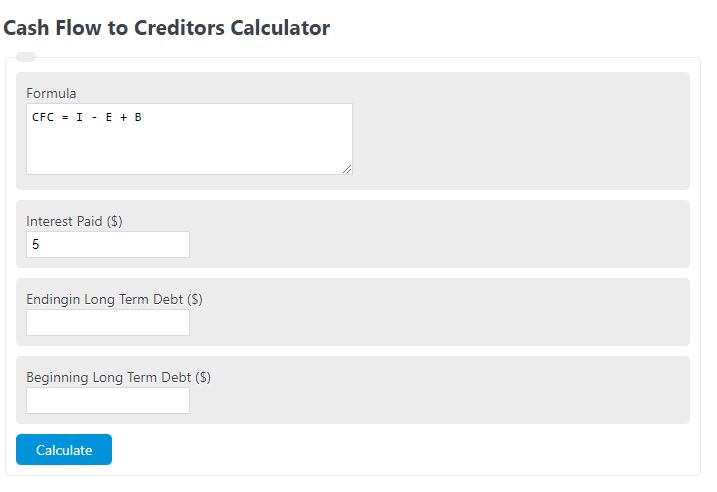

Creditors interest paid net new borrowing. E Ending Long Term Debt. Equation for calculate cash flow to creditors is Cash Flow to Creditors I - E B.

Rated the 1 Accounting Solution. In other words the. Cash Flow to Creditors.

Where I Interest Paid. To calculate cash flow from financing activities add your dividends paid to the repurchase of debt and equity then subtract the total number from cash inflows from issuing equity or debt. Beginning cash is of course how much cash your business has on hand.

The direct method is exactly what it sounds like a direct way of calculating operating cash flow by deducting the total amount of cash expenses from the total amount of cash receipts. The simple formula above can be built on to include many different items that. Cash Flow to Creditors I - E B.

Ad 93 of small business owners are constantly leaking money on useless and unnoticed things. How do you calculate cash flow to creditors if you are not given long term debt. How do you calculate cash flow to creditors if you are not given long term debt.

Operating Cash Flow Net Income All Non-Cash Expenses Net Increase in Working Capital. A positive cash flow is good for the company as it determines financial success and a negative cash flow says otherwise. Where I Interest Paid E Ending Long Term Debt B Beginning Long Term Debt.

The formula of cash flow to. Add back all non-cash items. Net new borrowing asks for ending.

There are two different methods that can be used to. B Beginning Long Term Debt. Forecast your future cash position and regain your control on your business finances.

Net new borrowing asks for ending. It is calculated by subtracting Net New Borrowing from the interest payments.

How To Prepare Projected Balance Sheet

The Accounting Equation Is The Best Methods In Principle Of Accounting Accounting Basics Learn Accounting Accounting Education

Training Modular Financial Modeling Annual Forecast Model Debtors Creditors Debtors Modano

Create More With Microsoft Templates

The Accounting Equation Is The Best Methods In Principle Of Accounting Accounting Basics Learn Accounting Accounting Education

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

Cash Flow Statement What It Is And Examples

Debtors And Creditors Control Accounts Accounting Basics Financial Peace University Accounting

Download Free Cheat Sheets Or Create Your Own Cheatography Com Cheat Sheets For Every Occasion

Cash Flow To Creditors Calculator Calculator Academy

2 2 Cash Flow To Creditors Youtube

Topic 2 Financial Statements And Cash Flow Prof