when are property taxes due in madison county illinois

The median property tax in Madison County Illinois is 2144 per year for a home worth the median value of 122600. Madison County Property Tax Inquiry.

Illinois Property Tax Calculator Smartasset

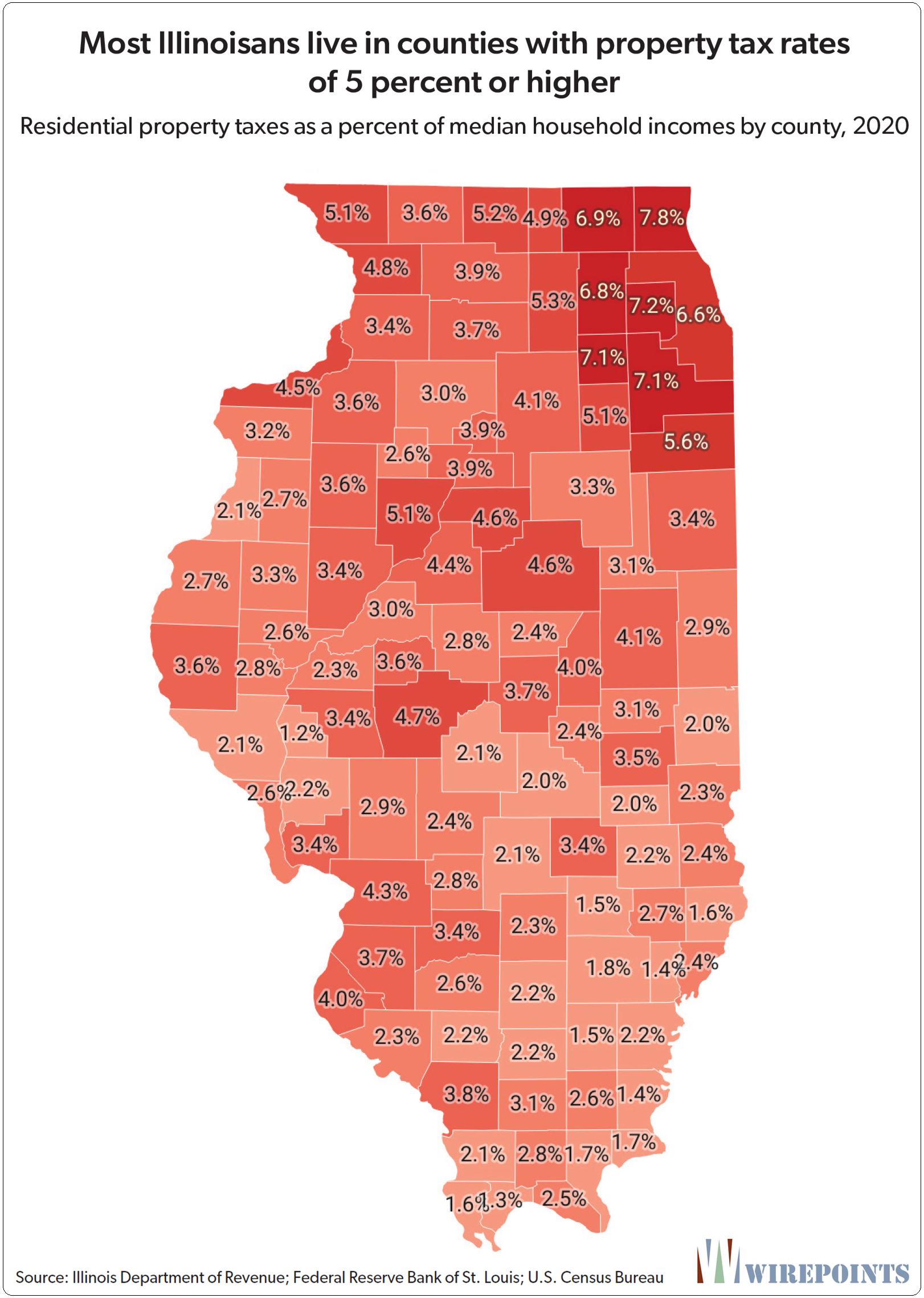

The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000.

. Madison County collects on average 175 of a propertys. Madison County Auditor Financial Reports. Property tax due dates for 2019 taxes payable in 2020.

Add together the 2021 spring and Sometimes mortgage companies pay the. The address for the. LAST DAY TO PAY PROPERTY TAXES FOR TY 2020 ON OUR WEBSITE WILL BE FEBRUARY 18 2022 at.

Madison County Clerk PO. Madison County Property taxes are paid in four installments. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on.

When are taxes due in Madison County. Indiana counties send annual statements to homeowners showing how much property tax is due on their property. 125 Edwardsville IL 62025.

To pay your property taxes in Madison County IL you can either mail your payment to the Madison County Treasurers Office or pay in person at the office. Madison County Treasurer IL 157 North Main Street Ste. Cook County WLS -- The second installment of Cook County property taxes are usually due by August but those bills have not even been sent out to taxpayers yet.

Monday - Friday E-mail. To search for tax information you may search by the 15 to 18 digit parcel number last name of property owner or site. Welcome to Madison County Illinois.

Statement of Economic Interest. Illinois gives real estate taxation power to thousands of community-based public entities. Pay your Madison County Illinois property tax bills online using this service.

Tax amount varies by county. Box 218 Edwardsville IL 62025. 173 of home value.

EDWARDSVILLE Madison County Treasurer Chris Slusser is reminding taxpayers that the third installment of their tax bill is coming due on Friday Oct. If you are making payments after January 3rd due to interest and late fees please call our office at 256 532-3370 for an exact tax amount due. Still property owners generally pay a single consolidated tax levy from the county.

Click here Pay your Madison County property. Madison County will conduct its Annual Real Estate Tax Sale at 10 am. In most counties property taxes are paid in two installments usually June 1 and September 1.

Current Tax Year-Taxing District Levy. 21 2023 in the Madison County Board Room Ste. Madison County Auditor Check Register.

Madison County Il Land For Sale 803 Listings Landwatch

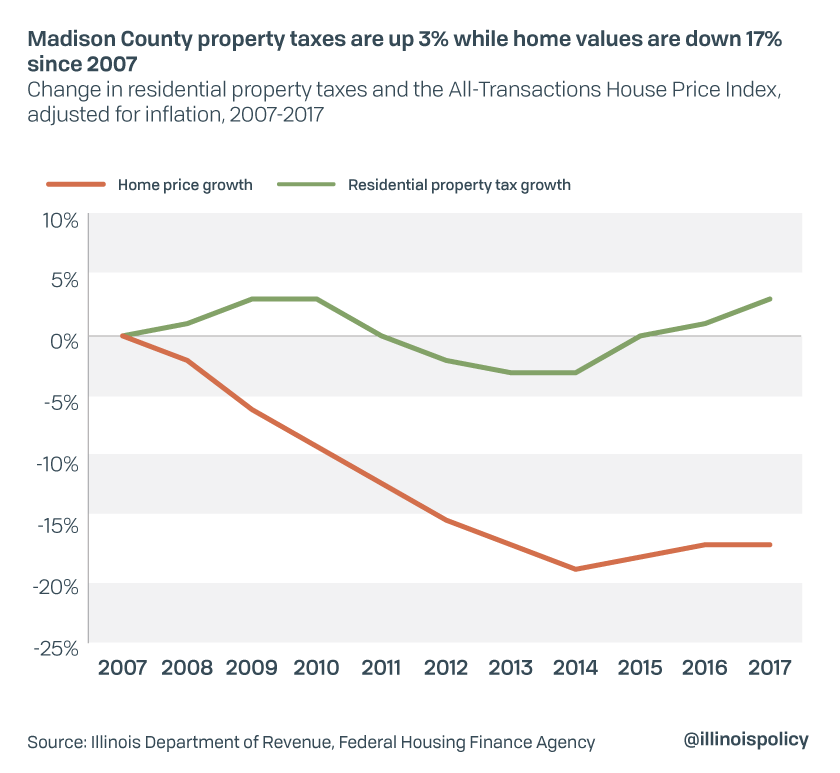

Madison County Home Values Down 17 Property Taxes Up 3 Since Recession

Illinois Property Tax Calculator Smartasset

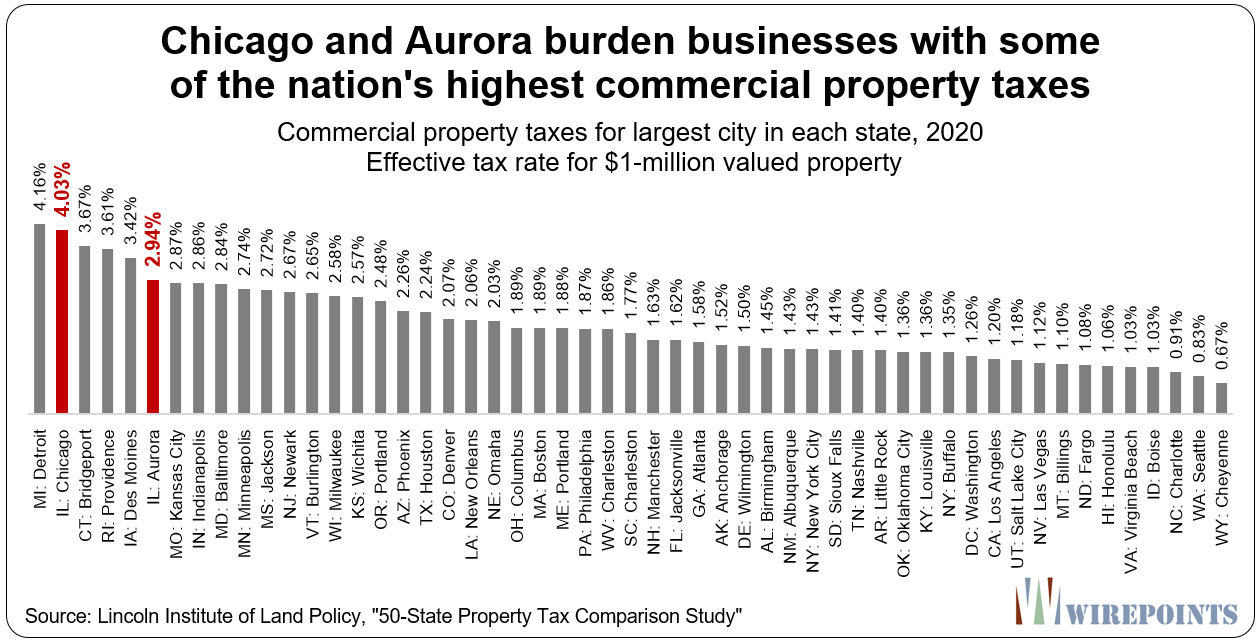

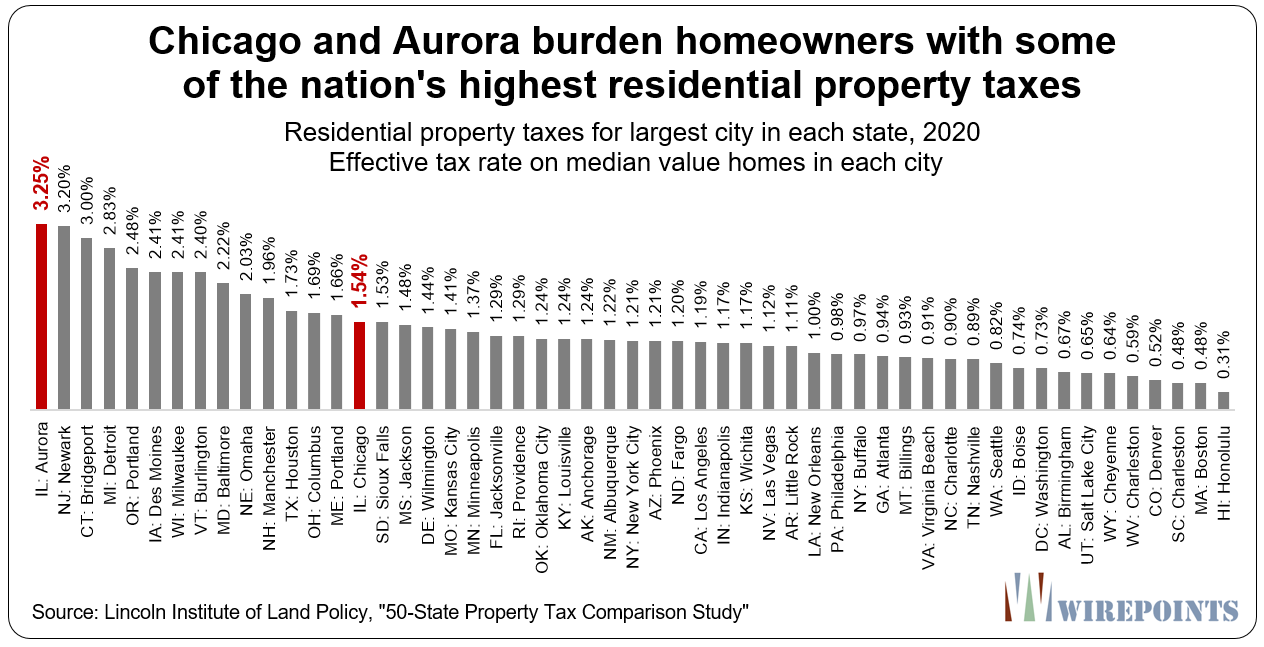

It S Not Just Illinois Homeowners That Suffer Businesses Pay Some Of The Nation S Highest Property Taxes Too Madison St Clair Record

It S Not Just Illinois Homeowners That Suffer Businesses Pay Some Of The Nation S Highest Property Taxes Too Madison St Clair Record

Madison County Sends Out Tax Bills Treasurer Addresses State Peers Illinois Business Journal

100 Best Apartments In Madison County Il With Pictures

Madison County Treasurer Reminds Property Owners Of First Installment Of Tax Bills Due July 8 Riverbender Com

Madison County Il Board Votes To Strip Prenzler Of Powers Belleville News Democrat

Thirty Years Of Pain Illinoisans Suffer As Property Tax Bills Grow Far Faster Than Household Incomes Home Values Madison St Clair Record

Property Tax Due Dates Treasurer

Choosing Between Missouri And Illinois What Is Life Really Like Across The River

One Injured In Massive Madison Fire Granite City News Advantagenews Com

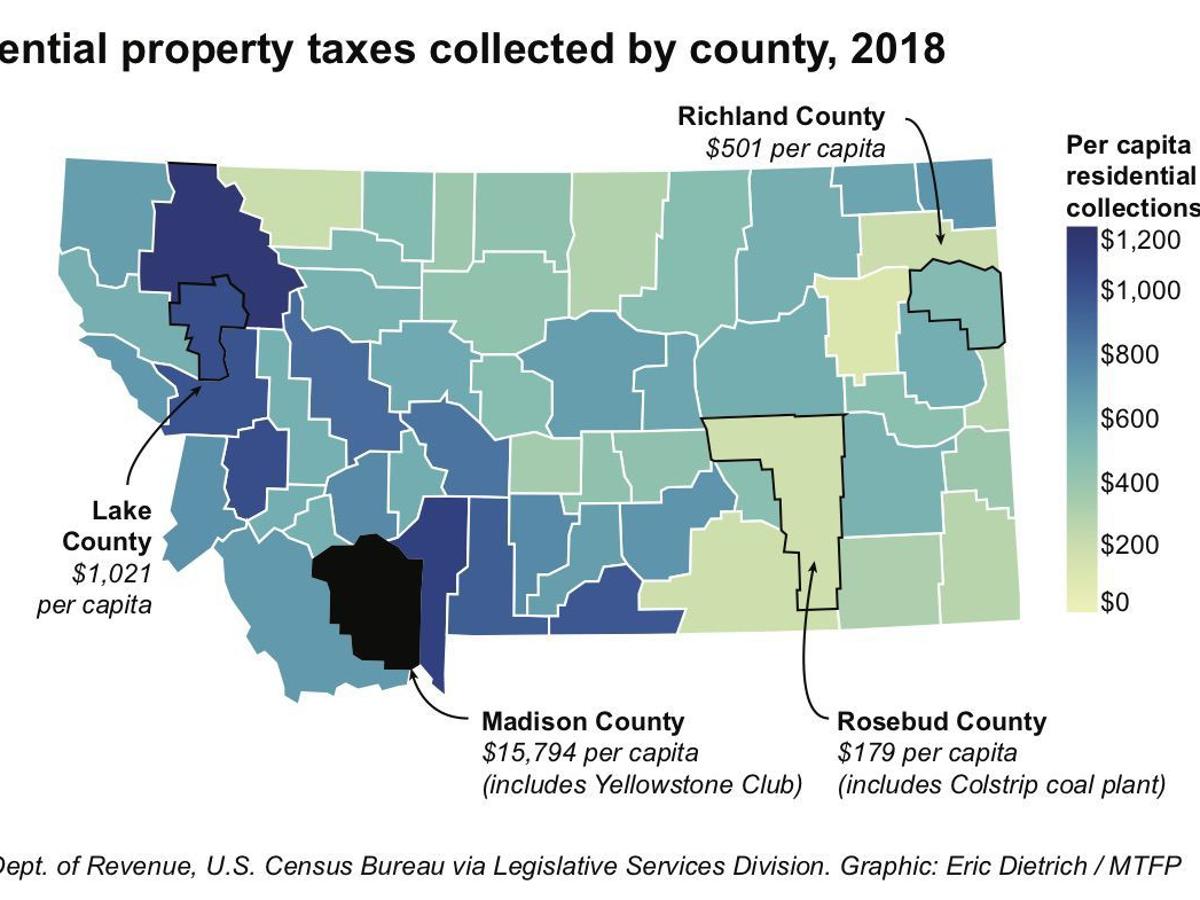

Montana Property Taxes Keep Rising Here S Where Residents Shoulder The Heaviest Loads News Bozemandailychronicle Com